Which of the Following Best Describes Monetary Policy

Financial capital markets D. Controlling the firms money in circulation.

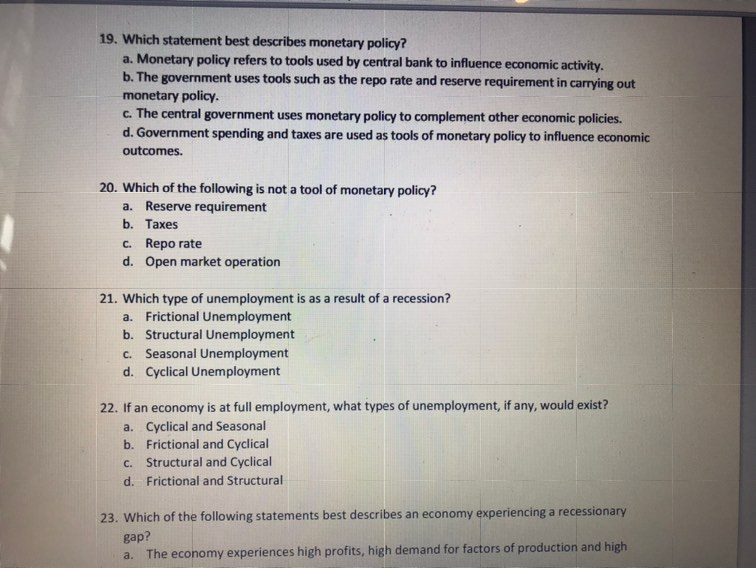

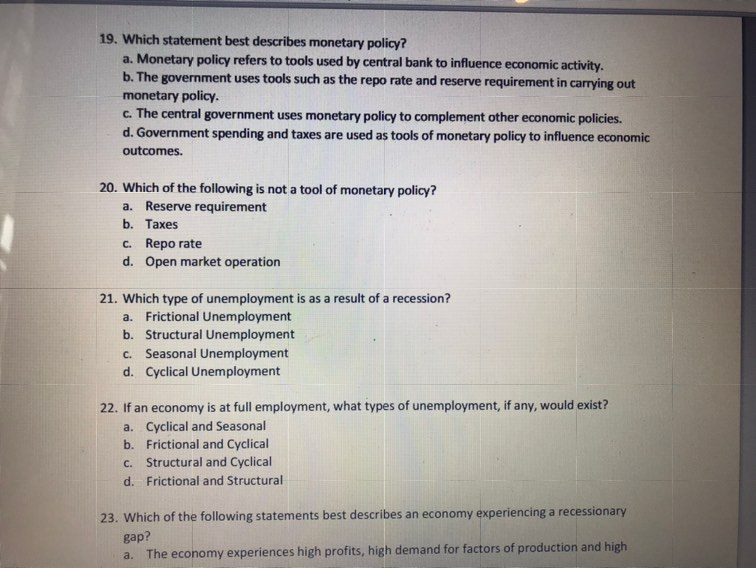

Solved 19 Which Statement Best Describes Monetary Policy Chegg Com

It is usually implemented by central banks in USA by the FED and it consists on using available instruments like bonds supply rediscount rates money supply etc to exert controll over the supply of money and the interest rates when possible in order to achieve specific goals like.

. Which of the following best describes Monetary Policy. Which best describes how the FOMC conducts monetary policy to increase employment during a recession to achieve its maximum employment objective. Which of the following best describes monetary policy.

Which of the following best describes a fiscal policy tool. Which of the following best describes the objectives of the Monetary Policy. It sells Treasury securities in the.

In the parlance of economics there are two kinds of policies that are used to control the money supply and inflation rate in a given. 2 on a question. It increases the target rate range for the federal funds rate.

This is often contrasted with the fiscal policy of a country. Controlling household money in circulation. Managing or manipulating the money supply in the economy.

Expansionary monetary policy directly puts money into the loanable funds market. O A combination of inflation and recession usually resulting from a supply shock A model that explains short-run fluctuations in real GDP and the price level. Monetary policy is one of the tools that governments have to influence economy.

4 Which of the following best describes a monetary policy tool. Which of the following best describes the objectives of the Monetary Policy. Investment is a component of aggregate demand so this shifts aggregate demand to the right.

Which of the following best explains why raising the required reserve ratio results in a decrease in the money supply. Thus the main objective of monetary policy is to control cost and availability of money. Monetary Policy is concerned with governments attempts to provide a more stable economy by regulating the rate of growth of the money supply.

Which of the following is a monetary policy tool. Controlling banks over our currencies b. Controlling household money in circulation c.

Managing the economy by controlling the money supply. Whenever the money supply is increased in a country inflation also rises because the competition among the people increases to avail goods and services. Controlling the firms money in circulation d.

Which of the following best describes the cause-effect chain of a expansionary monetary policy. When supply shifts cause a downturn in the economy. Increase in money supply d.

Controlling banks over our currencies. It decreases the target rate range for the federal funds rate. The interest rate targeted by the Federal Reserve when executing monetary policy.

Which of the following best describes bartleby. Government spending interest rates. To control cost and availability of money.

None of the choices. Which of the following best describes the cause-and-effect chain of an expansionary monetary policy. Lower interest rates e.

These goals are prescribed in a 1977 amendment to the Federal Reserve Act. Monetary policy is a policy that a central bank of a country used to effects the economy is some way by controlling the money flow. Which of the following is a monetary policy goal.

Monetary policy has two basic goals. Which of the following best describes a monetary. This lowers the interest rate which provides a larger incentive for firms to invest.

The Federal Reserves three instruments of monetary. Lower interest rates e. Decrease money supply c.

And The interest rate that is meant to influence other interest rates such as mortgage rates car loan rates etc. Managing or manipulating the money supply in the economy. What best describes The US Federal Reserve System A Is responsible for monetary policy and money supply B Prints money C Keeps the country out of debt D Helps people in need E None of the above.

Banks must loan out a smaller portion of their reserves resulting in fewer loans. The two main tools of macroeconomic policy include monetary policy and fiscal policy which involves _____ spending. 5 In the ______________ households receive goods and.

An increase in the money supply will lower the interest rate increase investment spending and increase aggregate demand and GDP. A decrease in the money supply will lower the interest rate increase investment spending and increase aggregate. It is usually implemented by central banks in USA by the FED and it consists on using available instruments like bonds supply rediscount rates money supply etc to exert controll over the supply of money and the interest rates when possible in order to achieve specific goals like.

None of the choices d. Answer verified by Toppr. Monetary policy is one of the tools that governments have to influence economy.

Which of the following best describes the Federal Funds rate. An increase in the money supply will lower the interest rate increase investment spending and increase aggregate demand and GDP. Which of the following best describes an contractionary monetary policy.

To promote maximum sustainable output and employment and to promote stable prices. The interest rate charged in short-term bank-to-bank loans. Which of the following best describes an expansionary monetary policy.

Changes in federal taxes and purchases that are intended to achieve macroeconomic policy objectives.

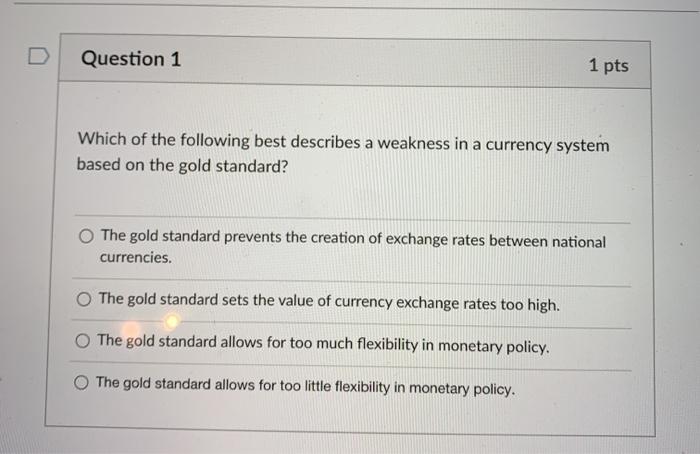

Solved Question 1 1 Pts Which Of The Following Best Chegg Com

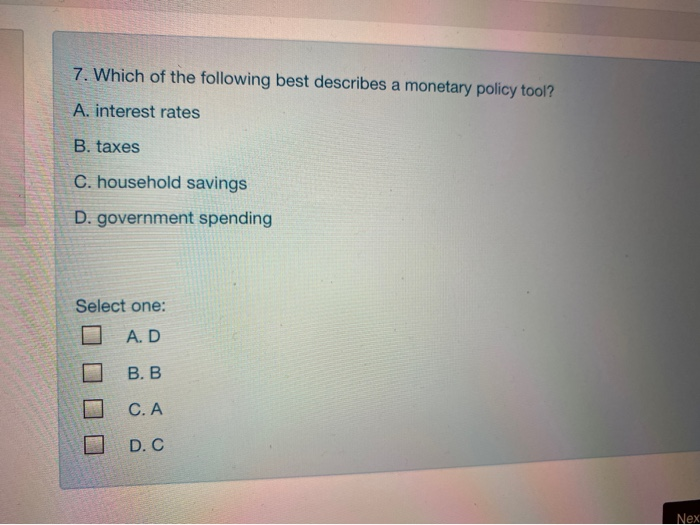

Solved 7 Which Of The Following Best Describes A Monetary Chegg Com

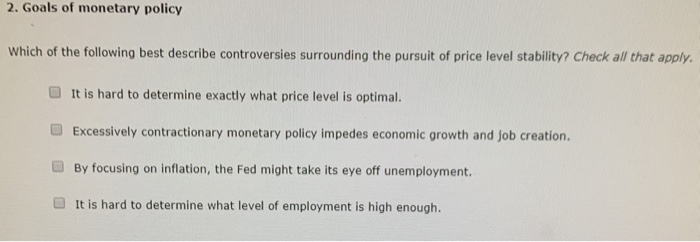

Solved 2 Goals Of Monetary Policy Which Of The Following Chegg Com

No comments for "Which of the Following Best Describes Monetary Policy"

Post a Comment